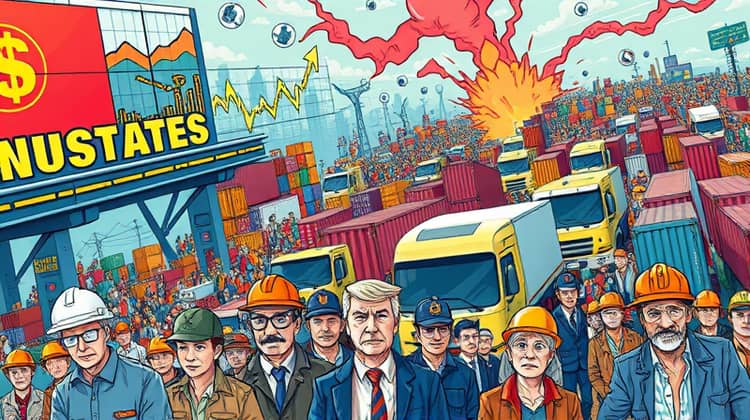

In today's interconnected world, geopolitical tensions are increasingly recognized as a significant force shaping the landscape of global economics. Events such as trade wars, military conflicts, and diplomatic standoffs can ripple across economies, affecting everything from trade routes to investor confidence.

As nations grapple with these tensions, the direct and indirect economic impacts become clear, influencing market behaviors, international relationships, and global stability. Understanding these dynamics is crucial for businesses, policymakers, and investors alike to navigate the complexities of a rapidly changing geopolitical environment.

Geopolitical Tensions: A Definition

Geopolitical tensions refer to conflicts or strains in relationships between nations, often driven by political, territorial, or economic disputes. These tensions can manifest in various forms, including military confrontations, trade disputes, and diplomatic standoffs that can significantly influence the global economic framework.

Understanding the nature of these tensions is essential, as they can lead to immediate and long-lasting effects on financial markets, trade relationships, and international cooperation. The ramifications extend beyond the countries directly involved, affecting global supply chains and investor behaviors.

- Military conflicts between nations

- Trade wars or economic sanctions

- Diplomatic disputes affecting alliances

Historical Context: Previous Instances and Their Economic Impacts

Throughout history, geopolitical tensions have shaped the economic landscapes of nations, impacting their growth and development. Analyzing past instances helps us understand the patterns and consequences of such tensions on global economies.

For instance, the Cold War created a divide that affected not only the United States and the Soviet Union but also smaller nations caught in the crossfire, limiting their economic opportunities.

- The Cold War's impact on global trade patterns

- The oil crisis of the 1970s and its economic implications

- The 2008 financial crisis and its ties to geopolitical tensions

Direct Economic Consequences

The direct economic consequences of geopolitical tensions often manifest quickly and violently, influencing everything from stock market fluctuations to changes in trade policies. These effects can disrupt supply chains, increase costs, and diminish consumer confidence.

Investors often react to perceived risks by either pulling out investments or diverting funds to safer havens, which can exacerbate the financial implications for countries involved.

- Increased trade barriers leading to higher costs

- Market volatility affecting investor confidence

- Job losses in sectors reliant on international trade

Indirect Economic Effects

Beyond the immediate economic consequences, geopolitical tensions can produce a range of indirect effects that may not be immediately observable. These can include shifts in public sentiment towards certain industries or countries, as well as long-term changes in consumer behavior driven by fear or uncertainty.

Companies may need to adapt their strategies, leading to shifts in hiring practices, investment in new markets, or changes in product sourcing. The knock-on effects can create an unstable business environment.

- Shift in consumer preferences due to perception of risk

- Long-term changes in investment patterns by firms

- Impact on local economies dependent on international trade

Case Studies

Exploring specific case studies provides insight into how geopolitical tensions have directly impacted economies around the world. These examples illustrate both immediate and long-term effects on countries involved and their trading partners.

1. U.S.-China Trade War

The recent trade war between the U.S. and China exemplifies significant geopolitical tension and its economic ramifications. Tariffs imposed by both nations have disrupted global supply chains, leading to increased costs for manufacturers and consumers alike.

- Rising costs of goods in the U.S.

- Disruption of supply chains for electronics

- Increased volatility in stock markets across both nations

2. Russia-Ukraine Conflict

The ongoing conflict between Russia and Ukraine has created economic instability in Europe and beyond, significantly impacting energy markets and agricultural exports. Sanctions imposed on Russia have led to increased energy prices, affecting economies worldwide.

- Surge in gas prices across Europe

- Impact on wheat exports affecting global food prices

- Increased investment in alternative energy sources

3. Middle East Conflicts

Conflicts in the Middle East have long influenced global economics, particularly through impacts on oil supply and prices. Ongoing tensions can drive significant price fluctuations, creating ripples through the global economy.

- Volatility in oil prices affecting inflation rates

- Regional instability impacting foreign investment

- Increased defense spending by surrounding nations

Financial Markets and Investor Behavior

Geopolitical tensions often create uncertainty in financial markets, leading to fluctuations that can have a profound impact on investment behavior. Investors tend to flee to safe-haven assets when tensions rise, thus driving volatility in riskier markets.

The response of financial markets not only reflects investor sentiment but can also exacerbate economic issues in the countries involved by increasing borrowing costs and reducing capital access.

- Increased demand for gold and other safe-haven assets

- Stock market declines during periods of heightened tension

- Higher bond yields as investors seek safer investments

Long-term Effects on Globalization

The long-term effects of geopolitical tensions on globalization can lead to a restructuring of international economic relationships. Nations may seek to become more self-sufficient, reducing their reliance on global supply chains that can be disrupted by political conflicts.

Additionally, the rise of protectionist measures can shape trade policies and lead to a fragmentation of the global economic system, impacting growth trajectories for many countries worldwide.

The implications of these changes may deter multinational investments and reshape the dynamics of global commerce in the years to come.

Conclusion

In conclusion, the economic impact of geopolitical tensions is multi-faceted and far-reaching, influencing immediate market behaviors and long-term global economic structures. As conflicts arise, it is essential for stakeholders to understand how these tensions can disrupt established norms and change the course of financial markets.

Businesses and investors must remain vigilant and adaptable, continuously assessing how geopolitical risks can affect their operations and investment strategies. Policymakers also play a crucial role in fostering stability and mitigating these risks through diplomacy and strategic partnerships.

In a world where geopolitical dynamics are ever-evolving, the ability to anticipate and respond to these tensions will be vital for sustaining economic growth and stability.